IMF warns U.S. deficits to top 7% of GDP through 2030

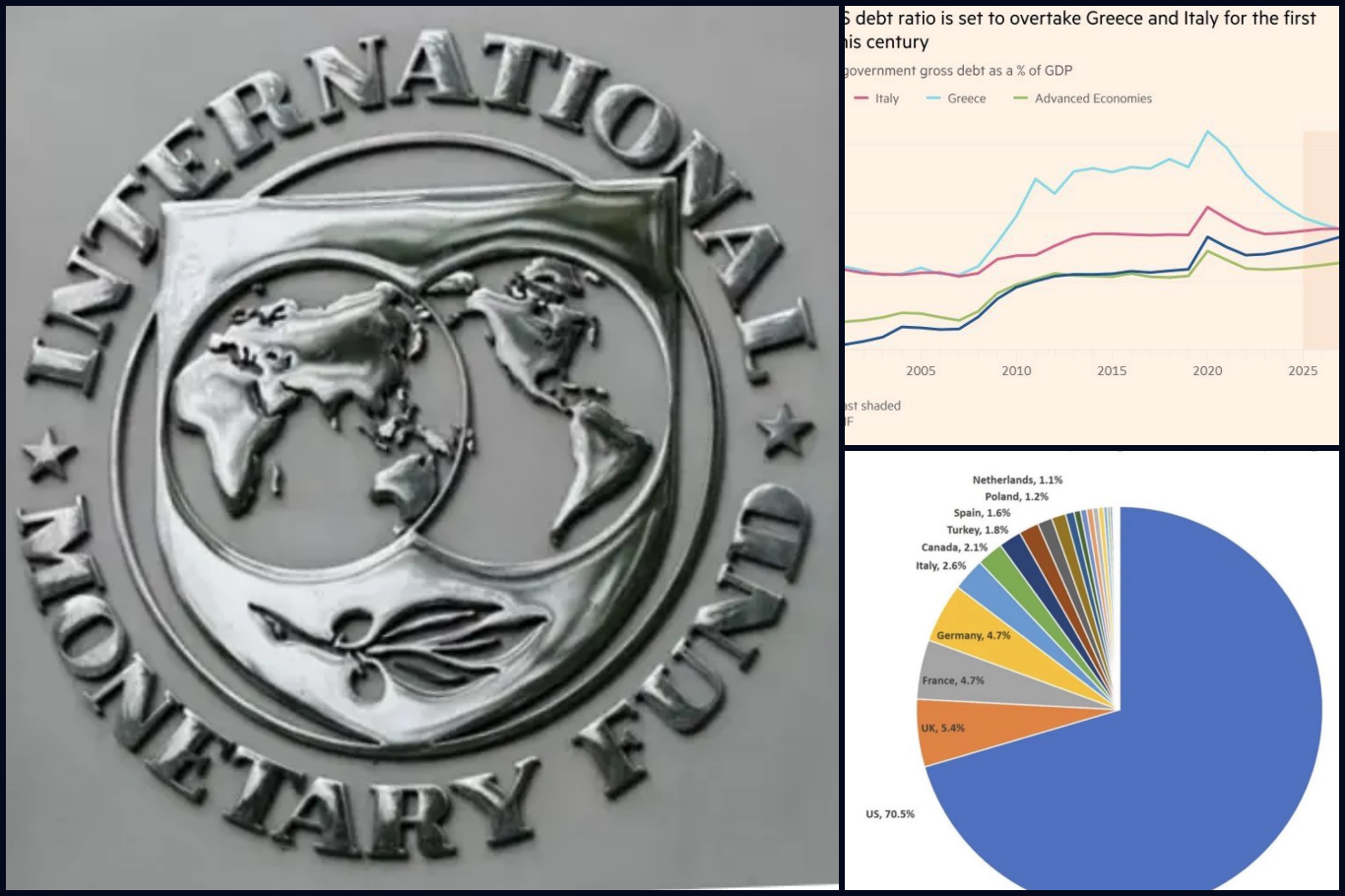

The International Monetary Fund (IMF) has projected that the United States’ general government gross debt will soar to 143.4% of GDP by 2035, surpassing long-indebted European economies such as Italy (137%) and Greece (130%) — marking a sharp reversal in global fiscal rankings.

The warning underscores growing unease about America’s spiraling deficits, relentless spending, and rising interest costs, which are eroding its reputation as a model of fiscal prudence.

For decades, the U.S. stood as a benchmark of financial stability, often serving as a creditor and global economic anchor. However, the IMF’s latest Fiscal Monitor shows the U.S. heading toward an unsustainable debt trajectory without sweeping policy reforms.

The national debt already exceeds $38 trillion, driven by expanding federal programs, costly tax cuts, and rising borrowing costs. Interest payments alone are consuming an ever-larger share of government revenue — a dynamic economists warn could eventually crowd out other essential public spending.

The projection is particularly notable when compared with Greece and Italy, two nations historically synonymous with debt crises. While both European economies were once chastised for their ballooning debt levels, their current fiscal outlooks have improved significantly due to strict budget controls and structural reforms.

Greece, after enduring a decade of austerity and international bailouts, has seen its debt-to-GDP ratio decline steadily, reflecting renewed growth and improved fiscal discipline. The U.S., by contrast, is moving in the opposite direction — with deficits expected to widen year after year through the 2030s.

The IMF’s analysis comes amid renewed debate in Washington over the country’s expansive fiscal policies. The U.S. is projected to run annual budget deficits exceeding 7% of GDP over the next five years — a level typically seen during wartime or major economic recessions.

The situation has been exacerbated by large-scale tax cuts for high-income earners and aggressive increases in federal spending, particularly under the administration of President Donald Trump, who championed what he called a “big, beautiful bill” to stimulate growth through lower taxes.

While the stimulus temporarily boosted consumer spending and business investment, it also forced the government to rely heavily on borrowing, further inflating the national debt.

Fiscal experts warn that unless the U.S. adopts structural reforms — such as adjusting spending priorities, increasing tax revenues, or reforming entitlement programs — the country may face rising borrowing costs and declining investor confidence.

“The U.S. is approaching a debt path typically associated with emerging markets or heavily indebted European economies,” said one economist cited by the IMF. “The difference is that America’s size and reserve currency status delay the reckoning — but not indefinitely.”

The IMF cautioned that the trajectory of U.S. public finances could have global consequences, as the U.S. dollar remains the world’s dominant reserve currency and U.S. Treasury bonds serve as the benchmark for global borrowing. A loss of fiscal credibility could raise global interest rates and destabilize financial markets.

While the U.S. still retains immense financial capacity and economic resilience, the IMF’s forecast serves as a warning: without policy correction, the world’s largest economy could soon mirror the very debt crises it once helped others to escape. (ILKHA)

LEGAL WARNING: All rights of the published news, photos and videos are reserved by İlke Haber Ajansı Basın Yayın San. Trade A.Ş. Under no circumstances can all or part of the news, photos and videos be used without a written contract or subscription.

Türkiye’s seasonally adjusted unemployment rate remained unchanged at 8.6% in September 2025, the Turkish Statistical Institute (TurkStat) announced on Monday.

Türkiye, Iran, and Afghanistan have signed a landmark memorandum of understanding (MoU) to strengthen railway cooperation, marking a significant step toward regional transport integration, officials from the three nations confirmed on Friday.

The Central Bank of the Republic of Türkiye (CBRT) has announced a 100 basis point cut in its benchmark one-week repo auction rate, lowering it from 40.5 percent to 39.5 percent, as part of its latest monetary policy decision.